How to Register and Trade CFD instruments (Forex, Crypto, Stocks) at IQ Option

How to Register in IQ Option

How to Register with an Email

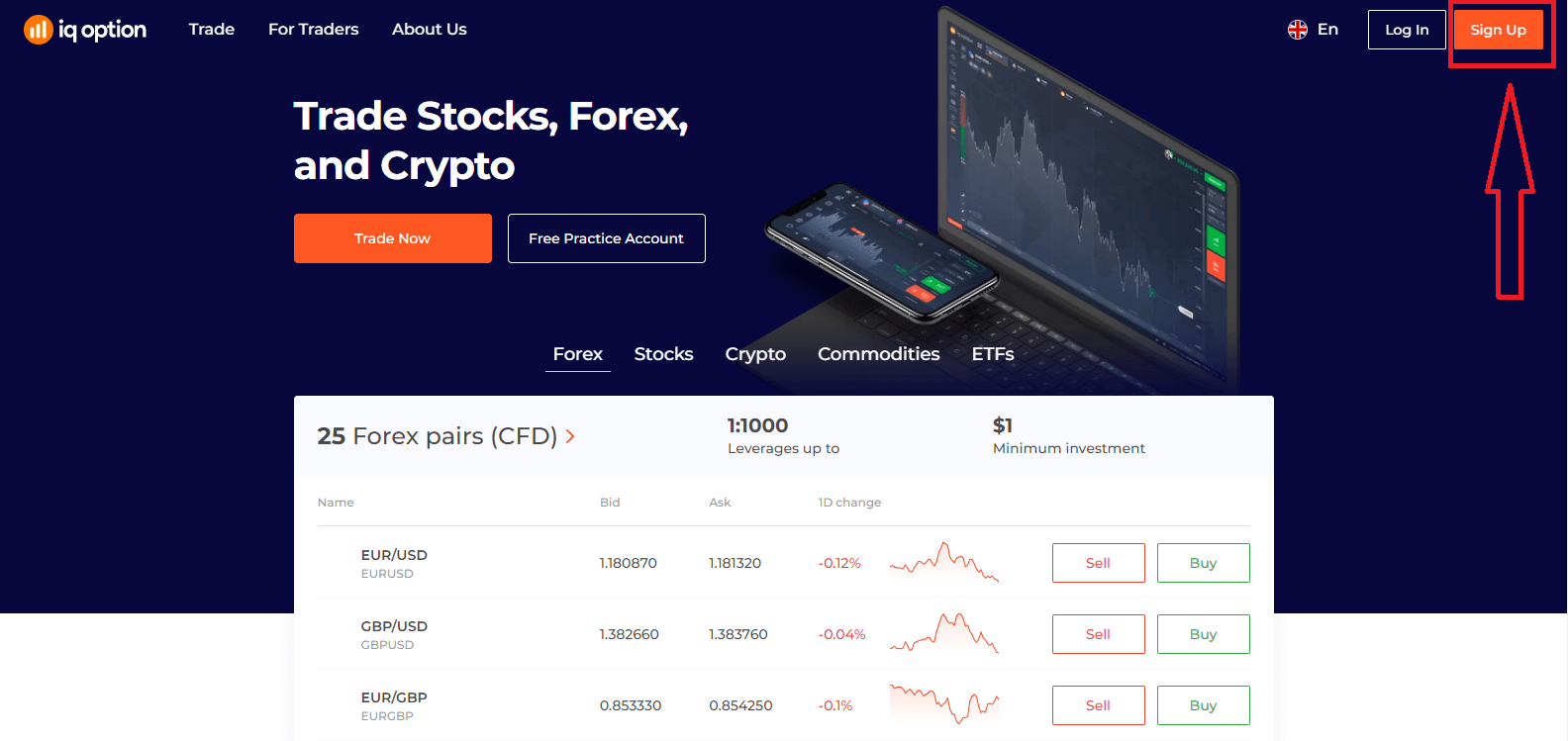

1. You can sign up for an account on the platform by clicking the “Sign Up” button in the upper right corner.

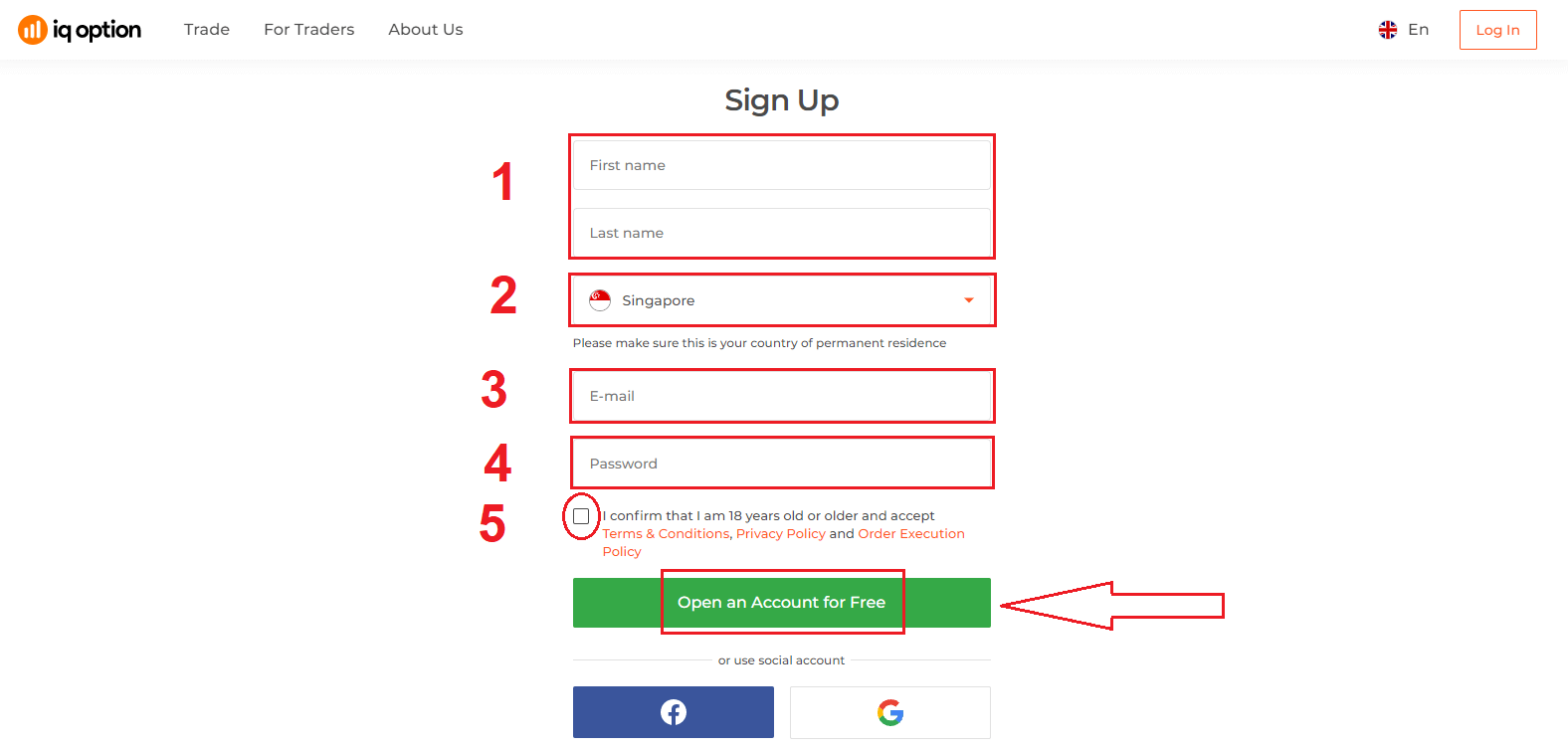

2. To sign-up you need to fill in all the necessary information and click "Open an Account for Free"

- Enter your First name and Last name

- Choose your country of permanent residence

- Enter a valid email address.

- Create a strong password.

- Read "Terms Conditions" and check it

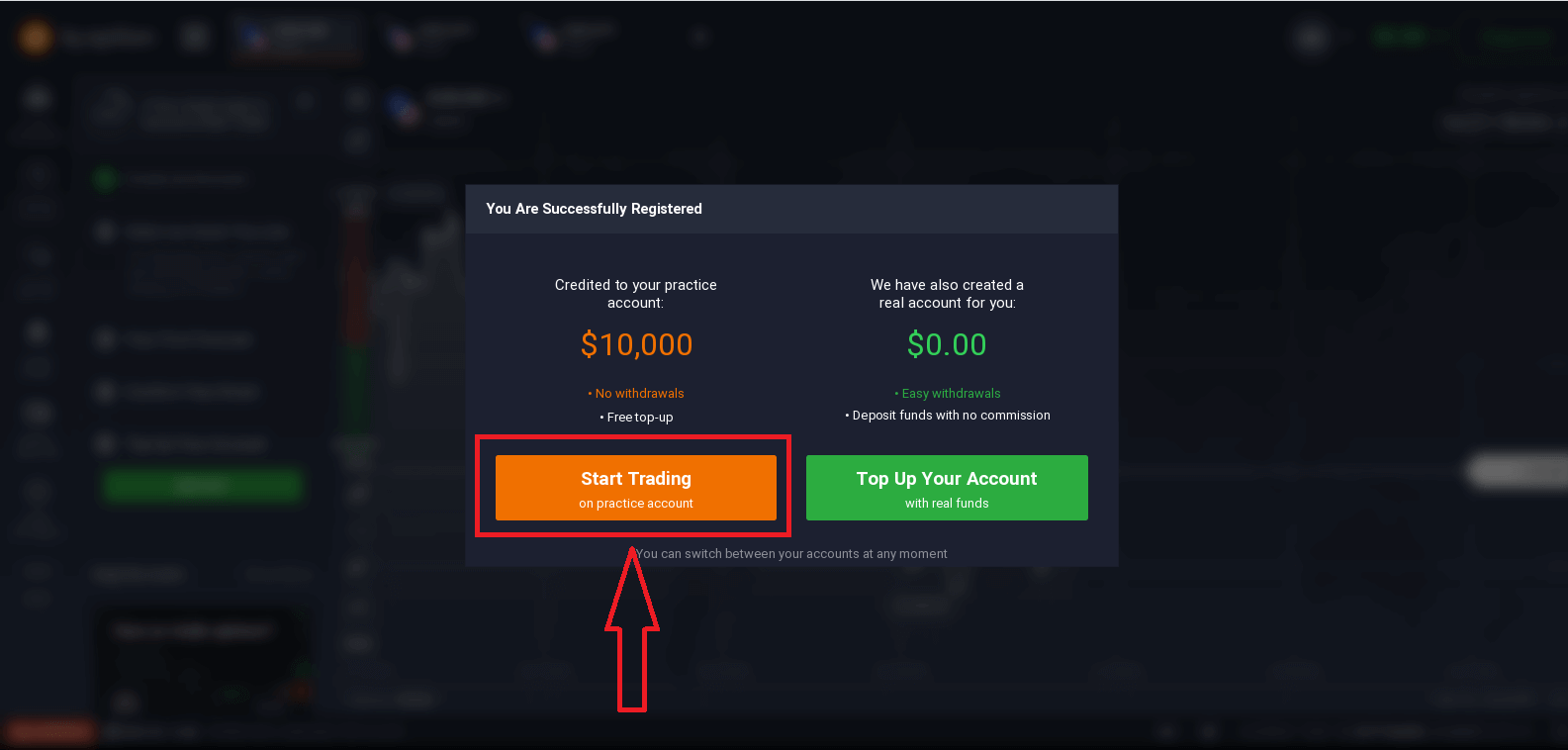

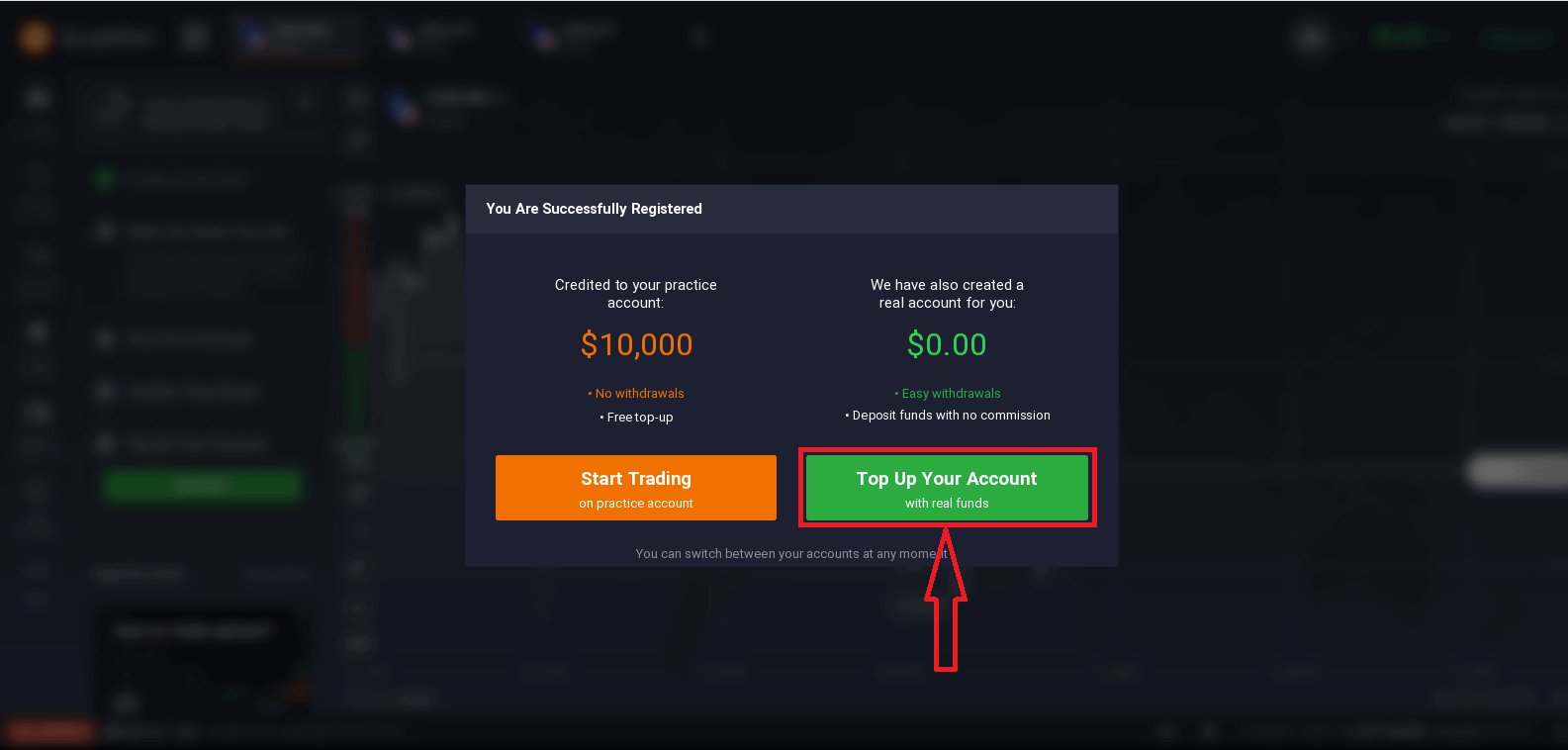

Congratulation! You have registered successfully. Now if you want to use Demo Account, click "Start Trading on practice account".

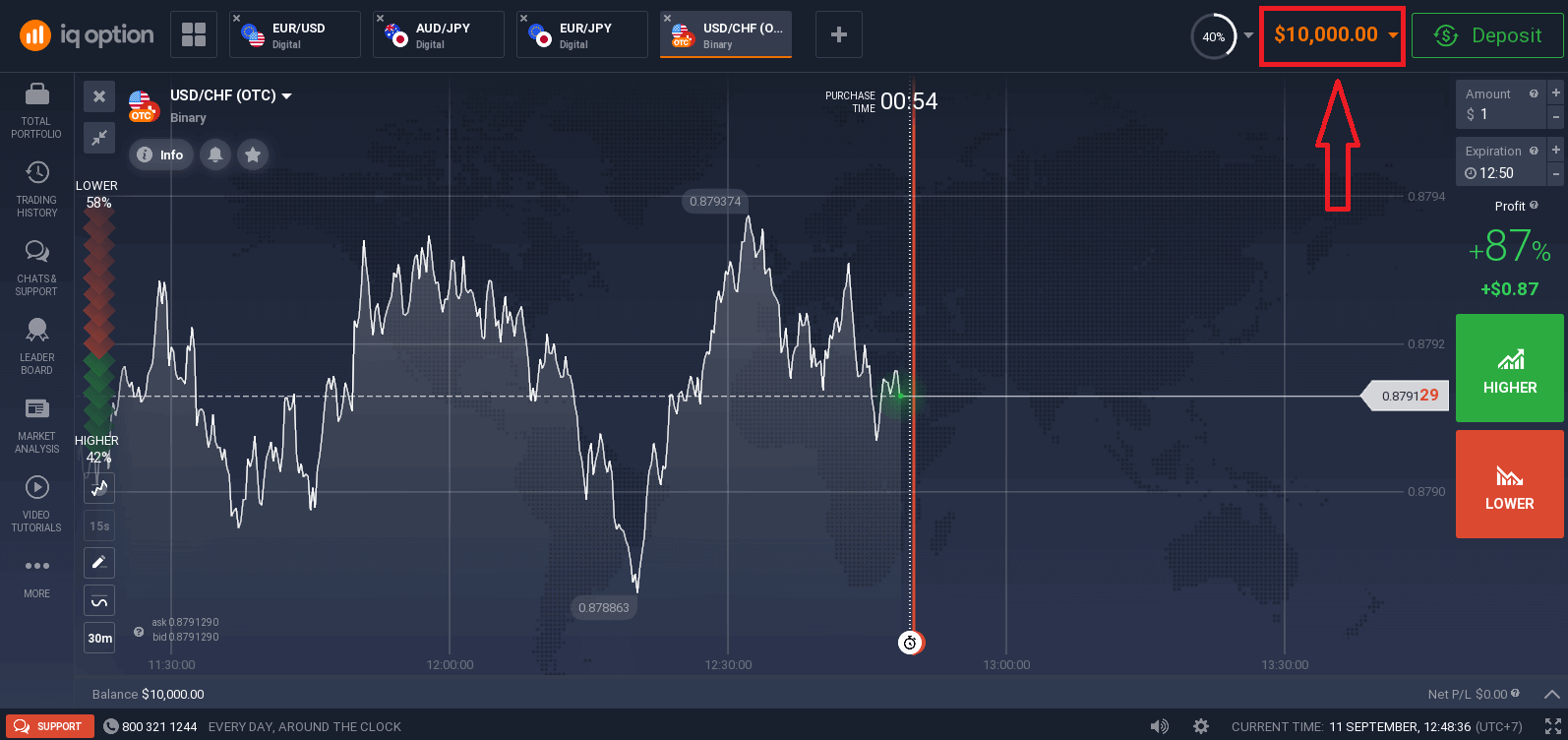

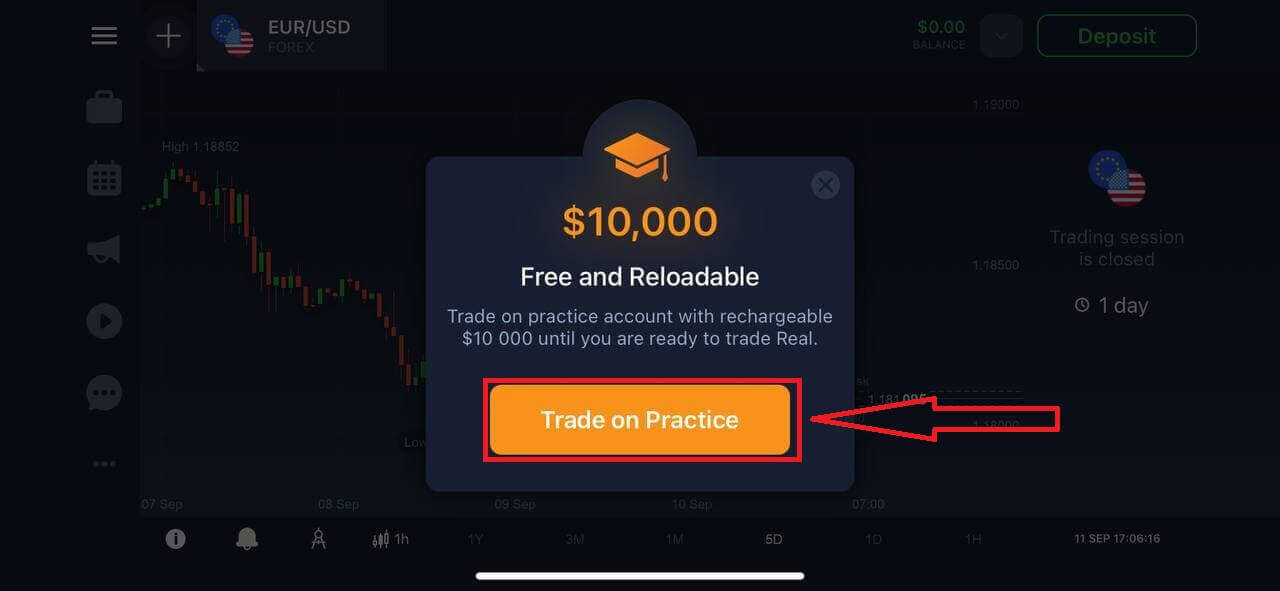

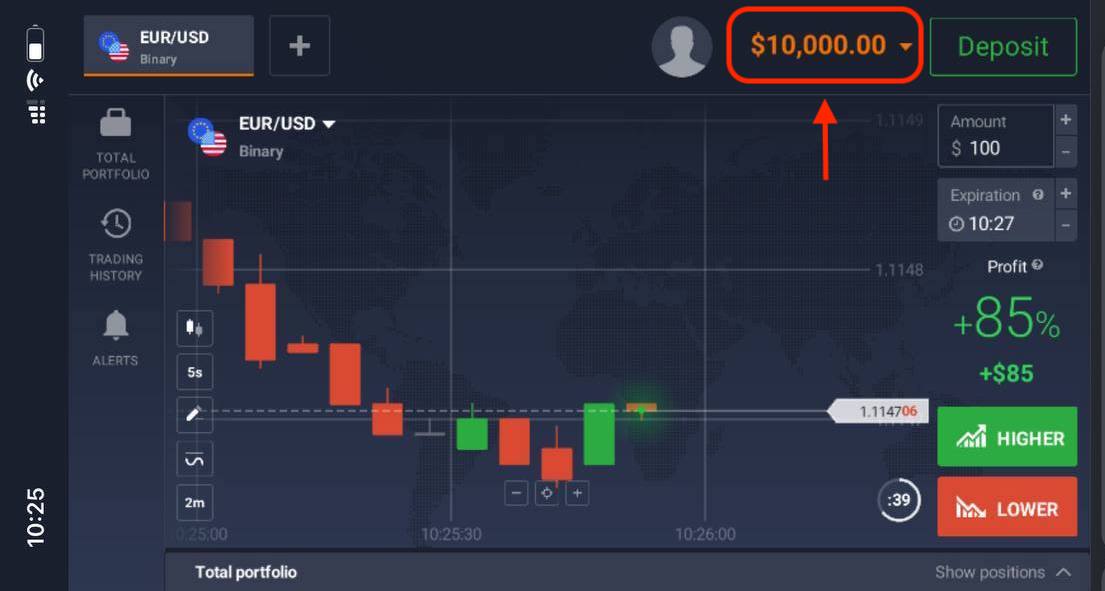

Now you are able to start trading. You have $10,000 in Demo Account. A demo account is a tool for you to get familiar with the platform, practice your trading skills on different assets and try out new mechanics on a real-time chart without risks.

You can also trade on a real account after depositing by clicking "Top Up Your Account with real funds".

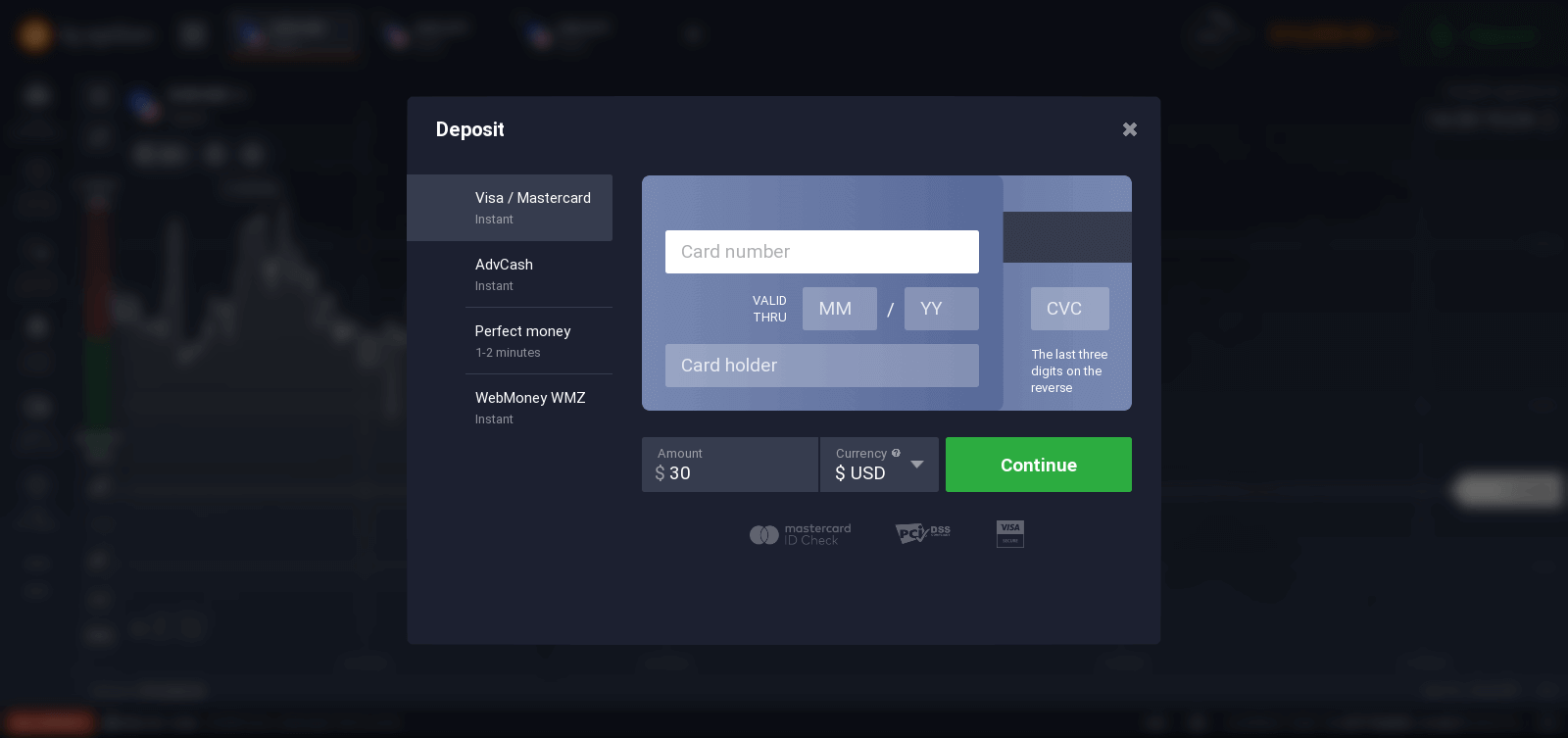

To start Live trading you have to make an investment in your account (The minimum deposit is 10 USD/GBP/EUR).

How to make a Deposit in IQ Option

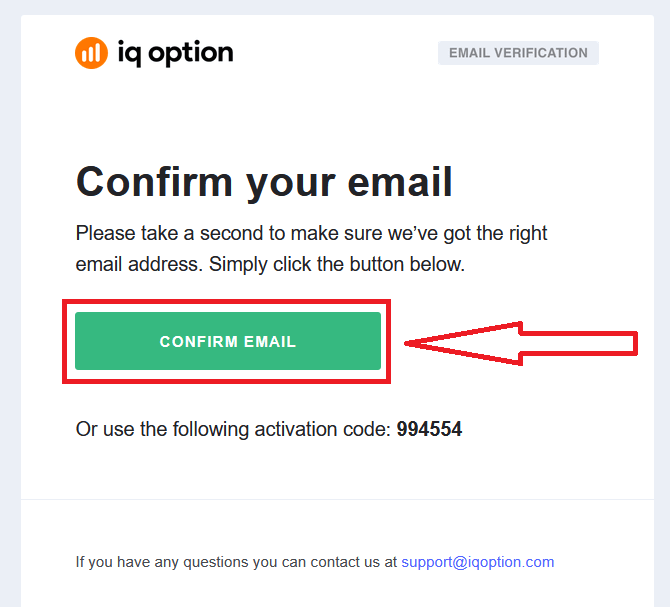

Finally, you access your email, IQ Option will send you a confirmation mail. Click the link in that mail to activate your account. So, you will finish registering and activating your account.

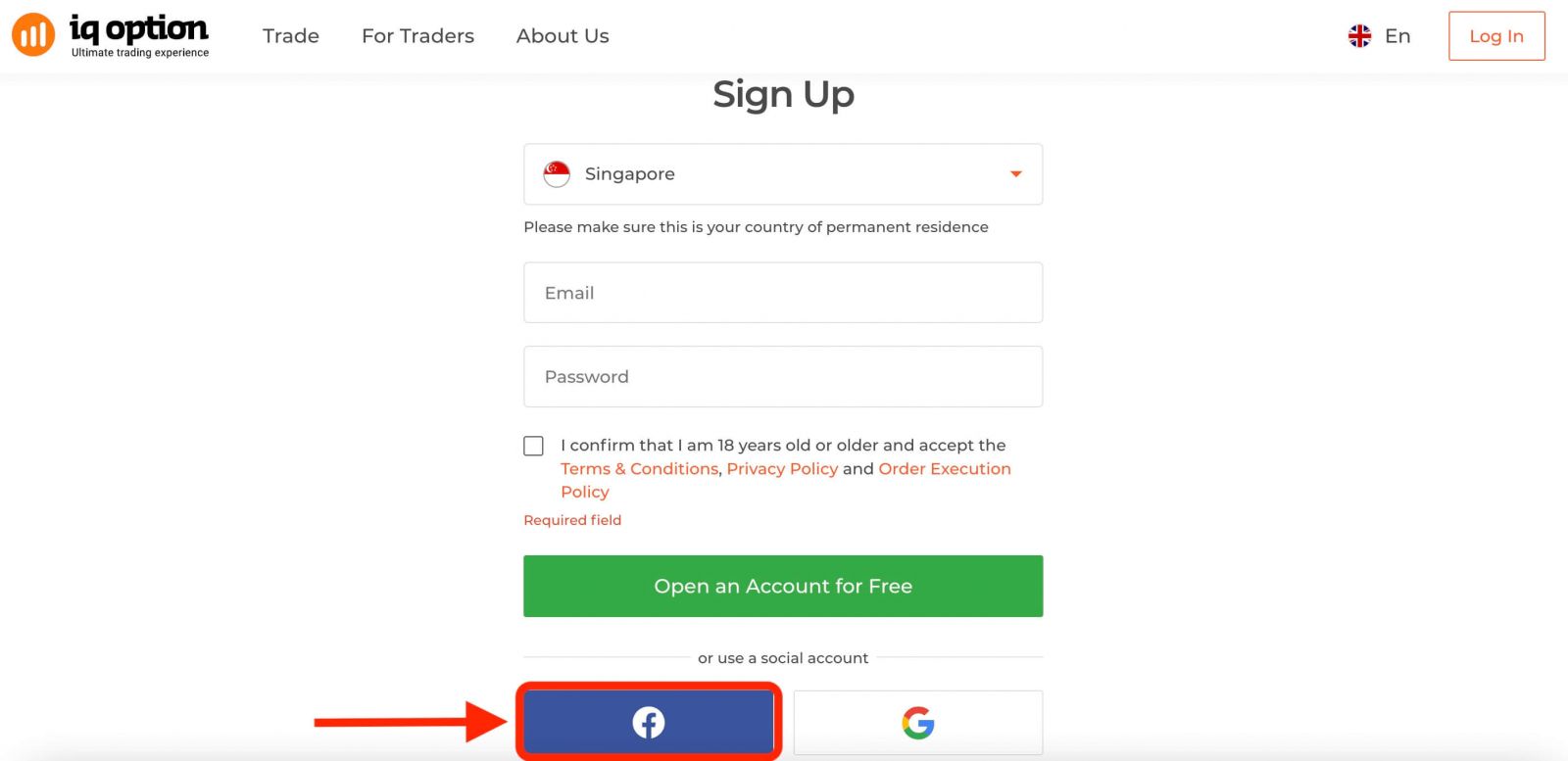

How to Register with a Facebook account

Also, you have the option to open your account through the web by Facebook account and you can do that in just few simple steps:1. Click on the Facebook button

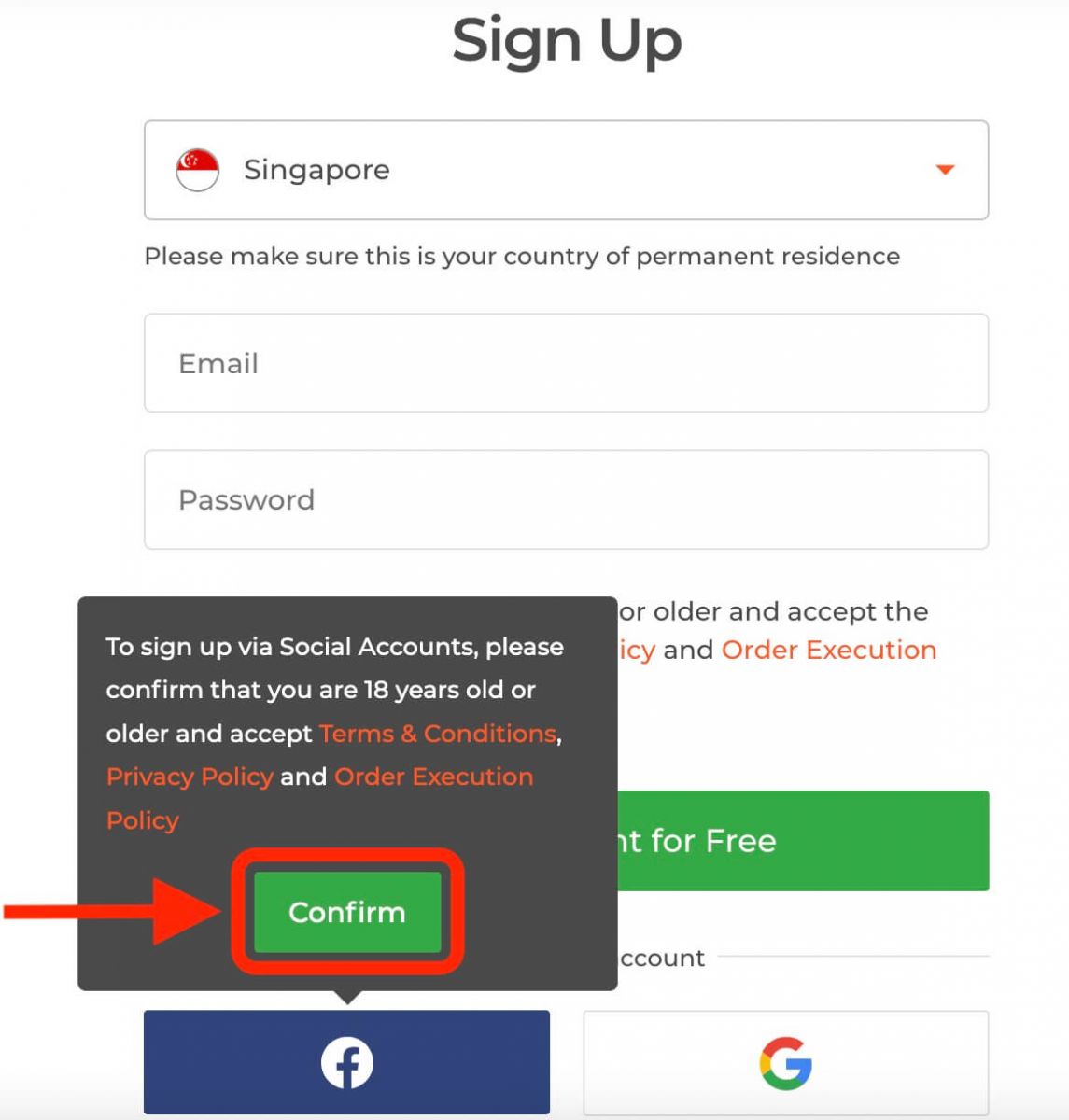

Then It will ask you that you are 18 years old or older and accept Terms Conditions, Privacy Policy and Order Execution Policy, click "Confirm"

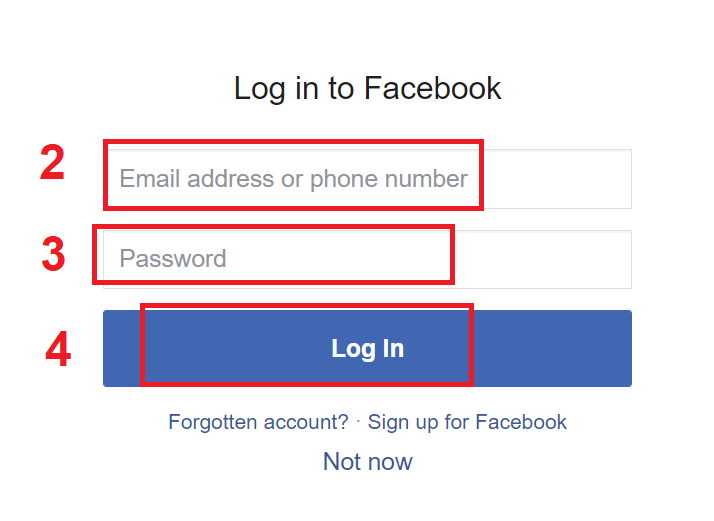

2. Facebook login window will be opened, where you will need to enter your email address that you used to register in Facebook

3. Enter the password from your Facebook account

4. Click on “Log In”

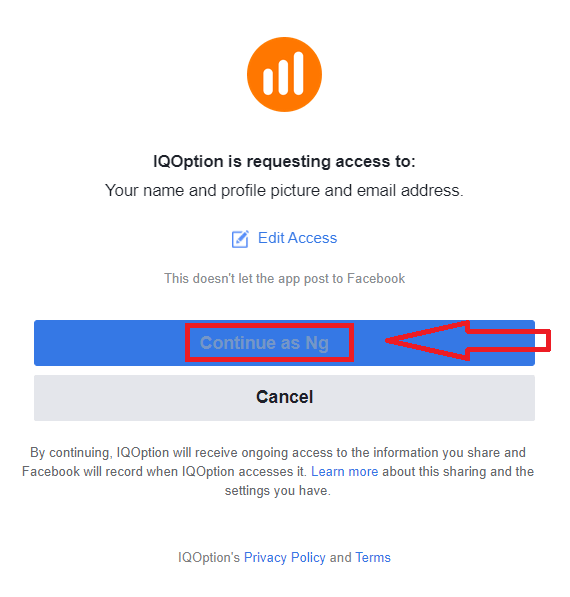

Once you’ve clicked on the “Log in” button, IQ Option is requesting access to: Your name and profile picture and email address. Click Continue...

After that You will be automatically redirected to the IQ Option platform.

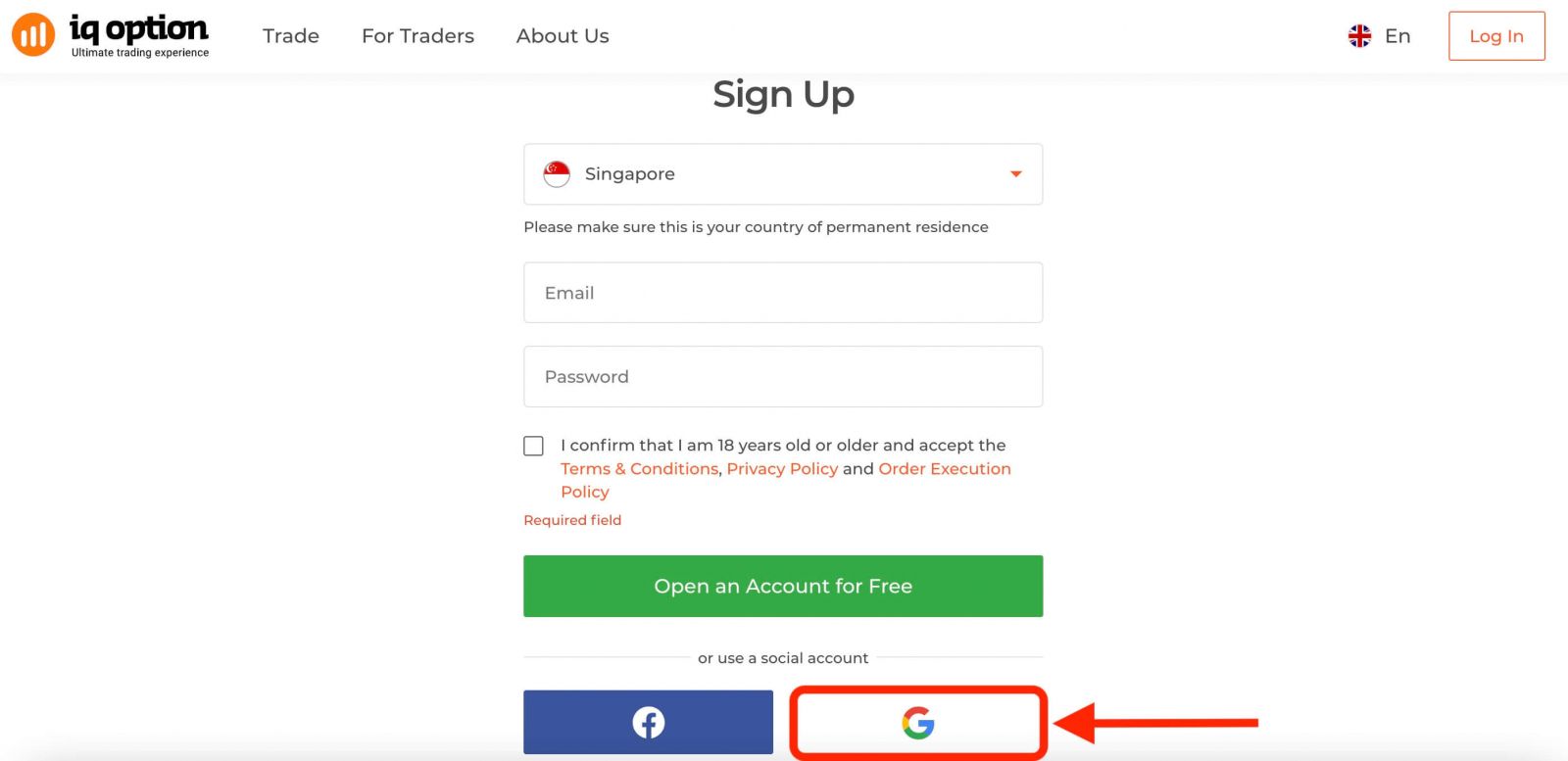

How to Register with a Google account

1. To sign up with a Google account, click on the corresponding button in the registration form.

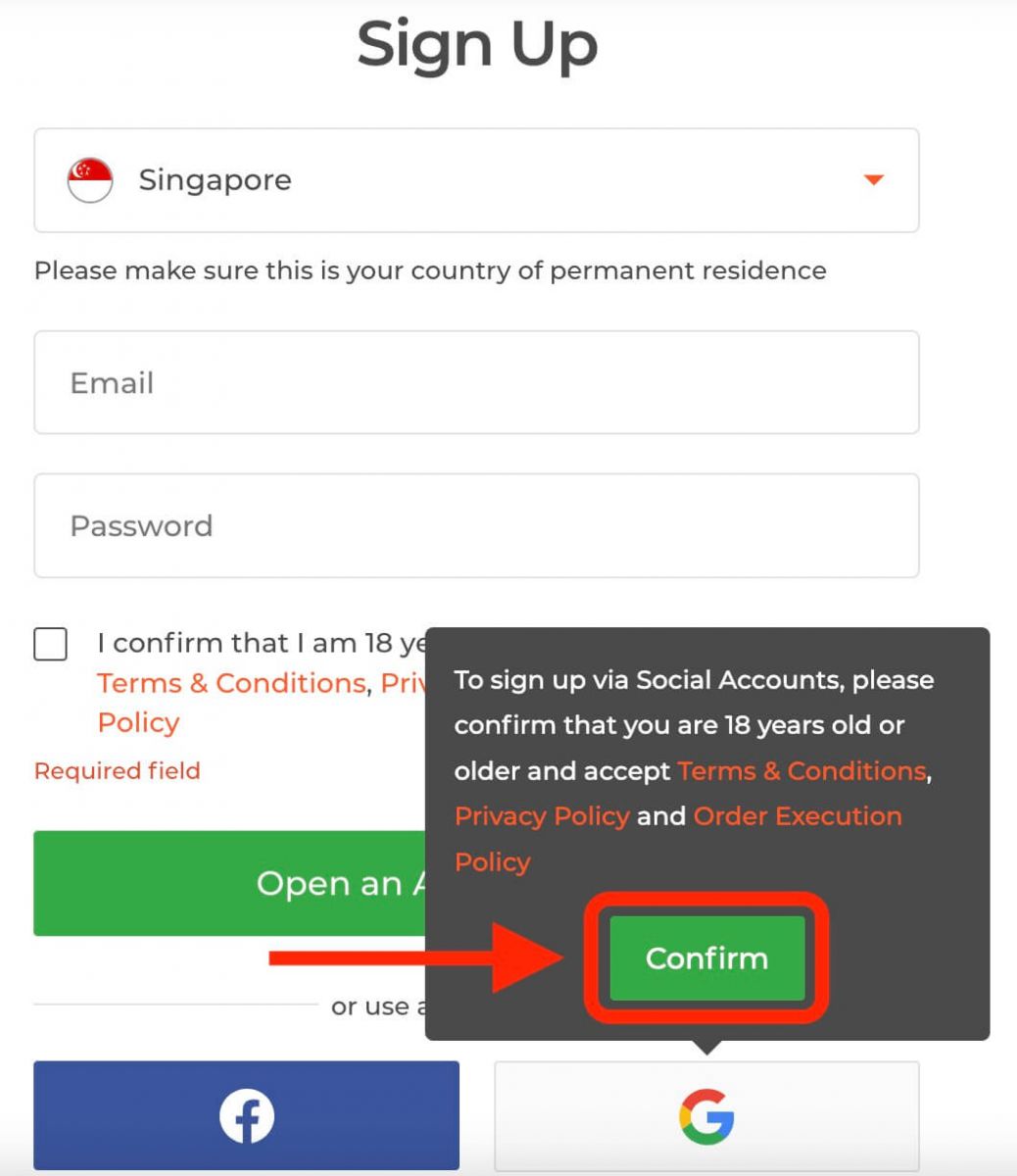

Then It will ask you that you are 18 years old or older and accept Terms Conditions, Privacy Policy and Order Execution Policy, click "Confirm"

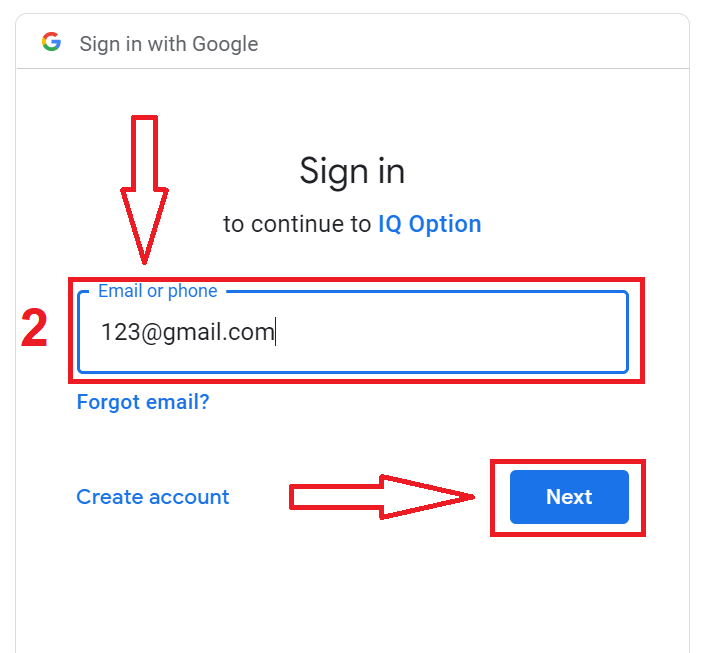

2. In the newly opened window enter your phone number or email and click "Next".

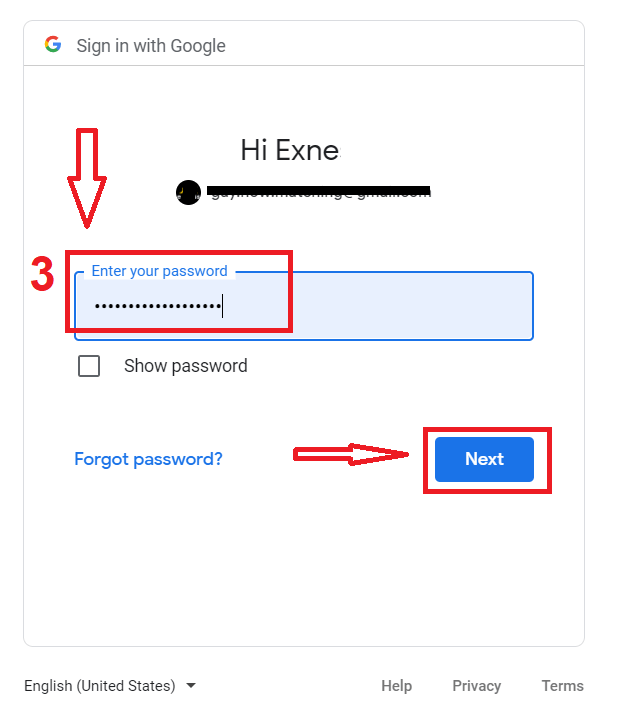

3. Then enter the password for your Google account and click “Next”.

After that, follow the instructions sent from the service to your email address.

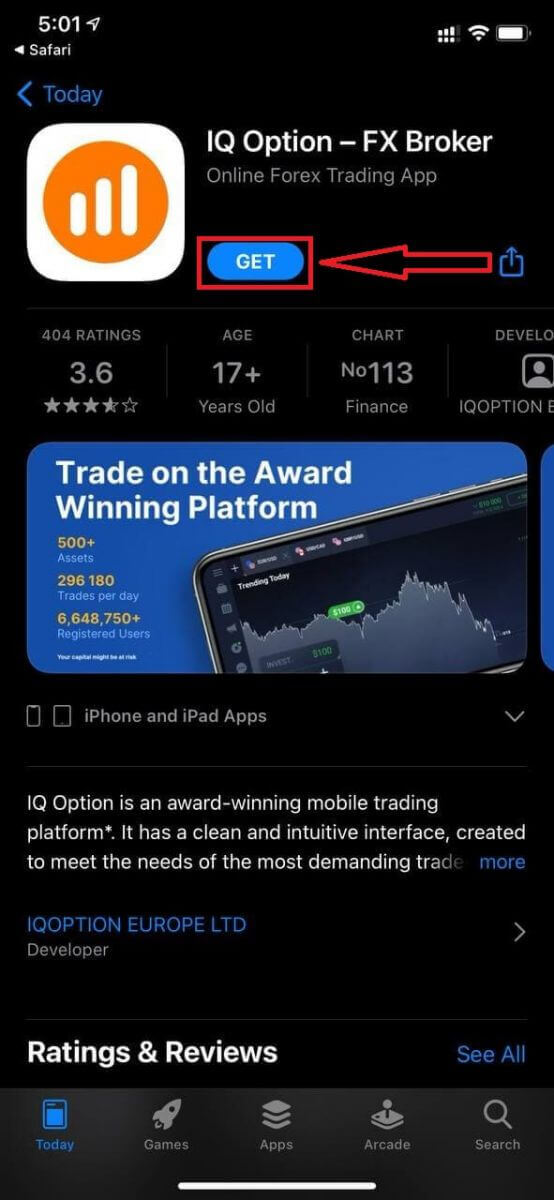

Register on IQ Option iOS App

If you have an iOS mobile device you will need to download the official IQ Option mobile app from App Store or here. Simply search for “IQ Option - FX Broker” app and download it on your iPhone or iPad.The mobile version of the trading platform is exactly the same as web version of it. Consequently, there won’t be any problems with trading and transferring funds. Moreover, IQ Option trading app for iOS is considered to be the best app for online trading. Thus, it has a high rating in the store.

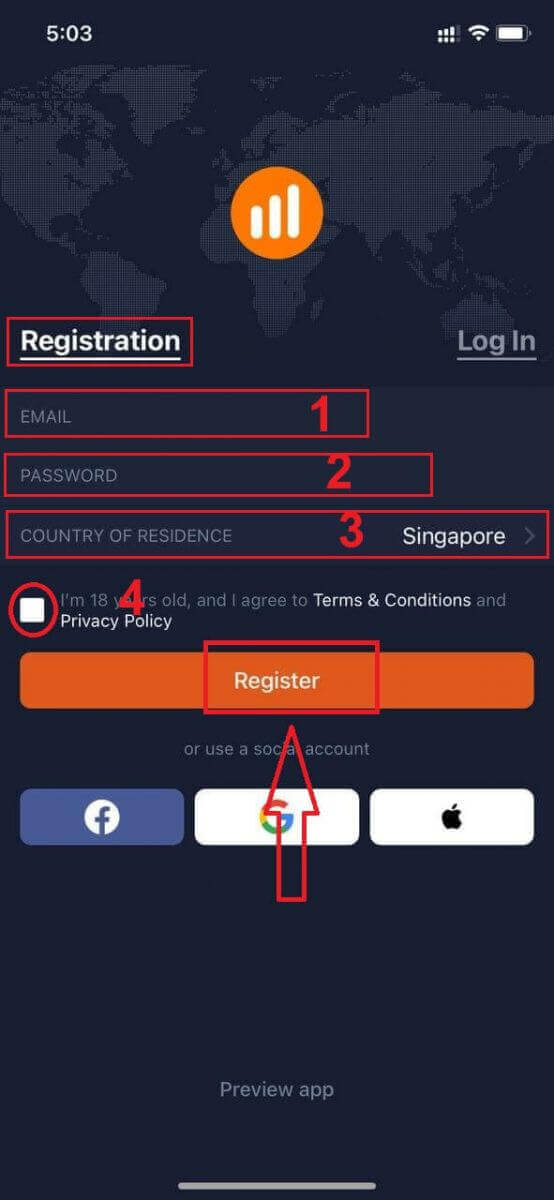

Registration for the iOS mobile platform is also available for you.

- Enter a valid email address.

- Create a strong password.

- Select your country of permanent residence

- Check "Terms Conditions" and click "Register"

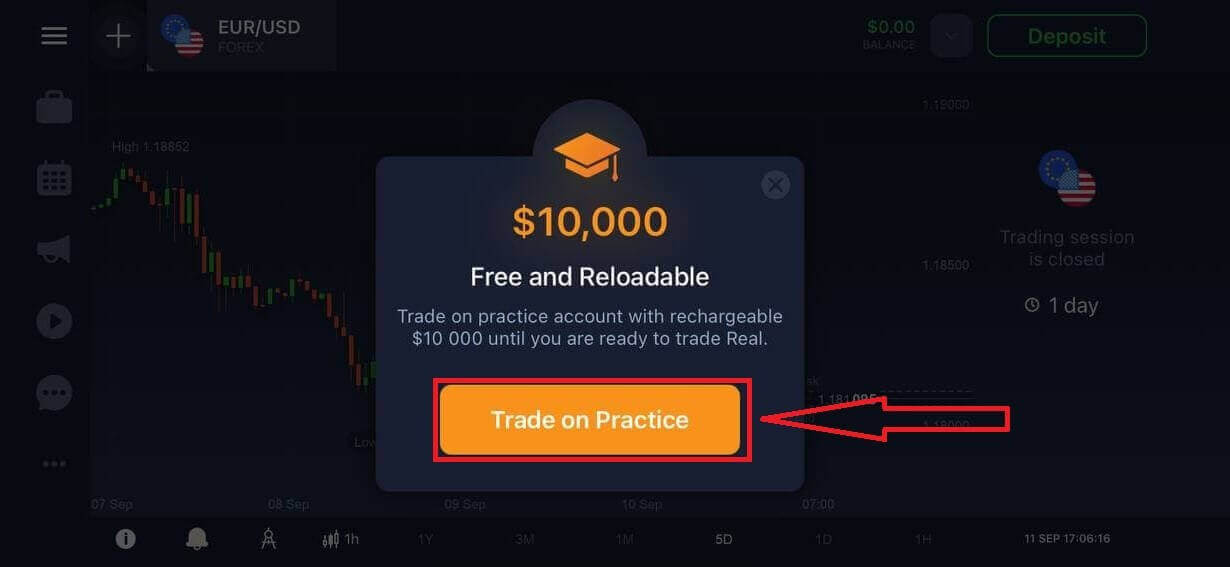

Congratulation! You have registered successfully, click "Trade on Pratice" for Trading with Demo Account.

You have $10,000 in Demo Account.

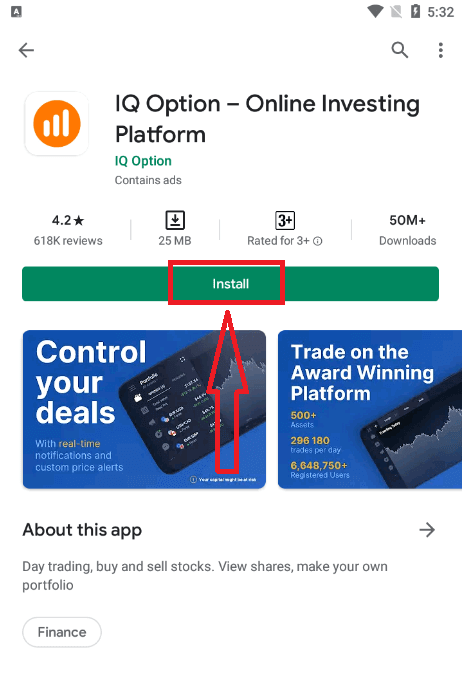

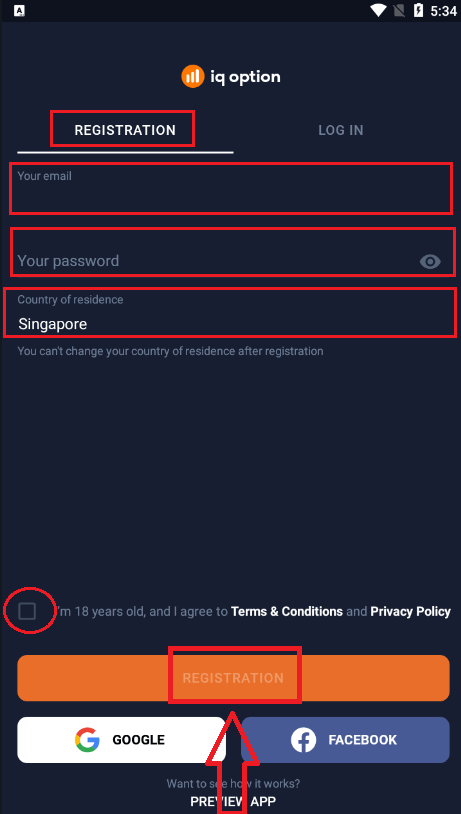

Register on IQ Option Android App

If you have an Android mobile device you will need to download the official IQ Option mobile app from Google Play or here. Simply search for “IQ Option - Online Investing Platform” app and download it on your device.The mobile version of the trading platform is exactly the same as web version of it. Consequently, there won’t be any problems with trading and transferring funds. Moreover, IQ Option trading app for Android is considered to be the best app for online trading. Thus, it has a high rating in the store.

Registration for the Android mobile platform is also available for you.

- Enter a valid email address.

- Create a strong password.

- Select your country of permanent residence

- Check "Terms Conditions" and click "Registration"

Congratulation! You have registered successfully, click "Trade on Practice" for Trading with Demo Account.

You have $10,000 in Demo Account.

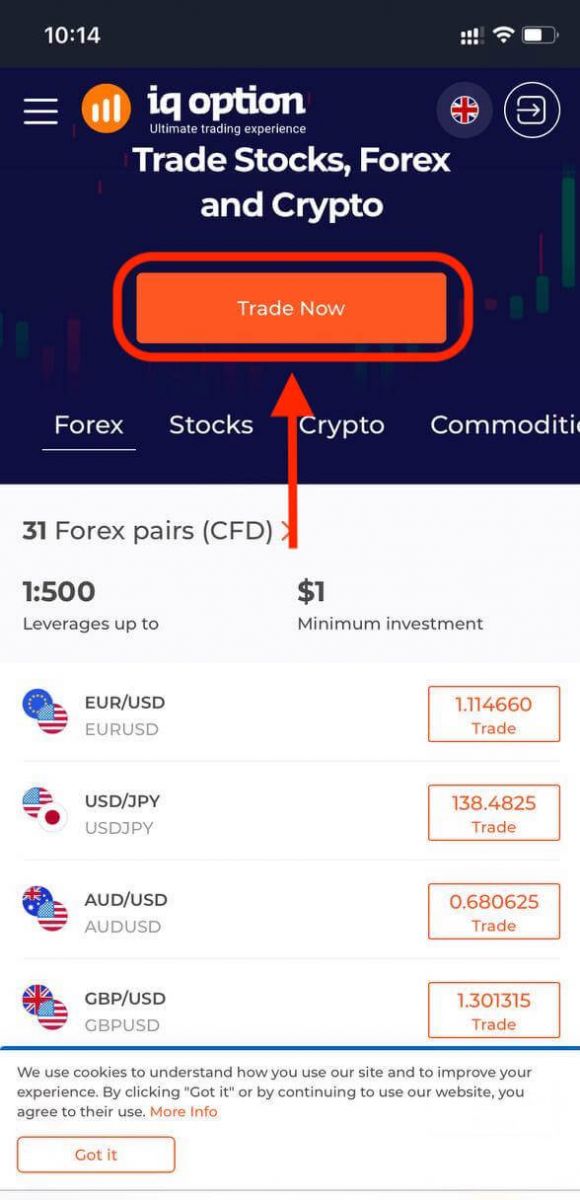

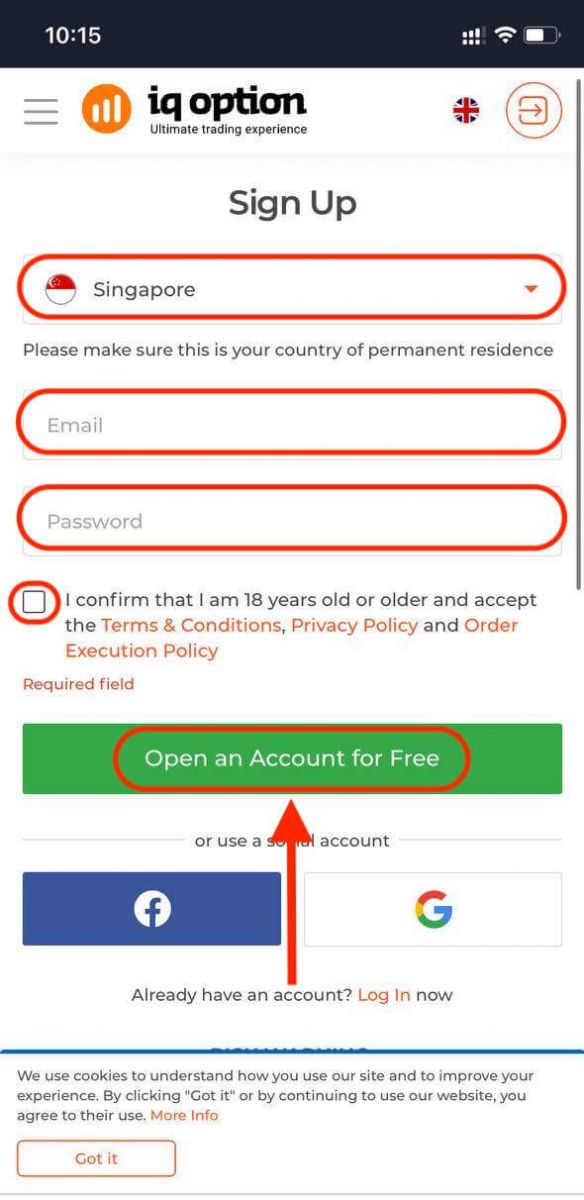

Register IQ Option account on Mobile Web Version

If you want to trade on the mobile web version of IQ Option trading platform, you can easily do it. Initially, open up your browser on your mobile device and visit the website of the broker.Tap the "Trade Now" button in the center.

At this step we still enter the data: email, password, check "Terms Conditions" and tap "Open an Account for Free".

Here you are! Now you are able to trade from the mobile web version of the platform. The mobile web version of the trading platform is exactly the same as a regular web version of it. Consequently, there won’t be any problems with trading and transferring funds.

You have $10,000 in Demo Account.

Frequently Asked Questions (FAQ)

How much money can I make on the practice account?

You cant take any profit from transactions you complete on the practice account. You get virtual funds and make virtual transactions. It is intended for training purposes only. To trade using real money, you need to deposit funds to a real account.

How do I switch between the practice account and the real account?

To switch between accounts, click your balance in the upper-right corner. Make sure you are in the traderoom. The panel that opens shows all your accounts: your real account and your practice account. Click an account to make it active so you can use it for trading.

How do I top up the practice account?

You can always top up your practice account for free if the balance falls below $10,000. First, you must select this account. Then click the green Deposit button with two arrows in the upper-right corner. A window opens where you can choose which account to top up: the practice account or the real one.

Do you have apps for PC, iOS, or Android?

Yes, we do! And on computers, the platform responds faster in the application for Windows and Mac OS. Why is it faster to trade in the application? The website is slower to update movements on the chart because the browser doesnt use available WebGL capabilities for maximizing the computers video card resources. The application doesnt have this limitation, so it updates the chart almost instantaneously. We also have apps for iOS and Android. You can find and download the applications on our download page.If a version of the app is not available for your device, you can still trade using the IQ Option website.

How can I secure my account?

To secure your account, use 2-step authentication. Each time you log in to the platform, the system will require you to enter a special code sent to your phone number. You can activate the option in the Settings.How to Trade CFD instruments at IQ Option

New CFD types available on the IQ Option trading platform include CFDs on stocks, Forex, CFDs on commodities and cryptocurrencies, ETFs.

The trader’s goal is to predict the direction of the future price movement and capitalize on the difference between current and future prices. CFDs react just like a regular market, if the market goes in your favor then your position is closed In The Money. In case market goes against you, your deal is closed Out Of The Money. The difference between Options trading and CFD trading is that your profit depends on the difference between entry price and closing price.

In CFD trading there is no expiration time but you are able to use a multiplier and set stop/loss and trigger a market order if the price gets a certain level.

CFDs on Crypto

In the past month cryptocurrency has made a serious leap and it seems that it is still reaching for new heights. With this crypto trend, though no trend lasts forever, crypto trading is becoming more and more popular. Today we are going to learn more about trading CFDs on cryptocurrencies on the IQ Option platform.

What is Crypto?

It seems that everyone knows the names of big cryptocurrencies – Bitcoin, Etherium, Ripple, Litecoin and so on. Many traders have already had some experience trading these currencies, or even purchasing them to hold on a long-term basis. But what is a cryptocurrency and what is the reason for their fall or rise in value?Cryptos are digital currencies, which means that they don’t have a physical form like paper money. One main feature that most cryptocurrencies have is that they are not issued by a central authority, which, theoretically, makes them immune to any manipulation or government interference. Many cryptocurrencies are based on the blockchain technology where the security of transactions is ensured by confirmations. As cryptocurrencies get accepted as a payment method, their popularity as a secure, anonymous and decentralized currency grows.

Cryptocurrency terms

As in any area, crypto trading has its own important rules and many terms that traders have to know in order to follow the market and understand the conditions well. Here are some of the most commonly used terms:Order – an order placed on the exchange to purchase or sell the cryptocurrency

Fiat – regular money, issued and supported by a state (like for example USD, EUR, GBP and so on)

Mining – processing and decrypting crypto transactions, with the purpose of getting new cryptocurrency

HODL – a misspelling of “hold” that stuck around with the meaning of purchasing cryptocurrency with the intention to keep it for a long time, with the expectation of the price growing

Satoshi – 0,00000001 BTC – the smallest part of a BTC, it can be compared to a cent in USD

Bulls – traders who believe that the price will rise and prefer to buy at low price to sell at a higher value later

Bears – traders who believe the asset price will decrease and may possibly benefit from the asset value going down

How to trade CFDs on Crypto with IQ Option?

Cryptocurrencies on IQ Option are provided as CFD-based trading. It means that when traders open deals, they make a prediction regarding the change in the price of the asset. Traders may speculate on the changes in price, however, they do not own the crypto coin itself.Here is a step-by-step explanation of CFD crypto trading on the IQ Option platform:

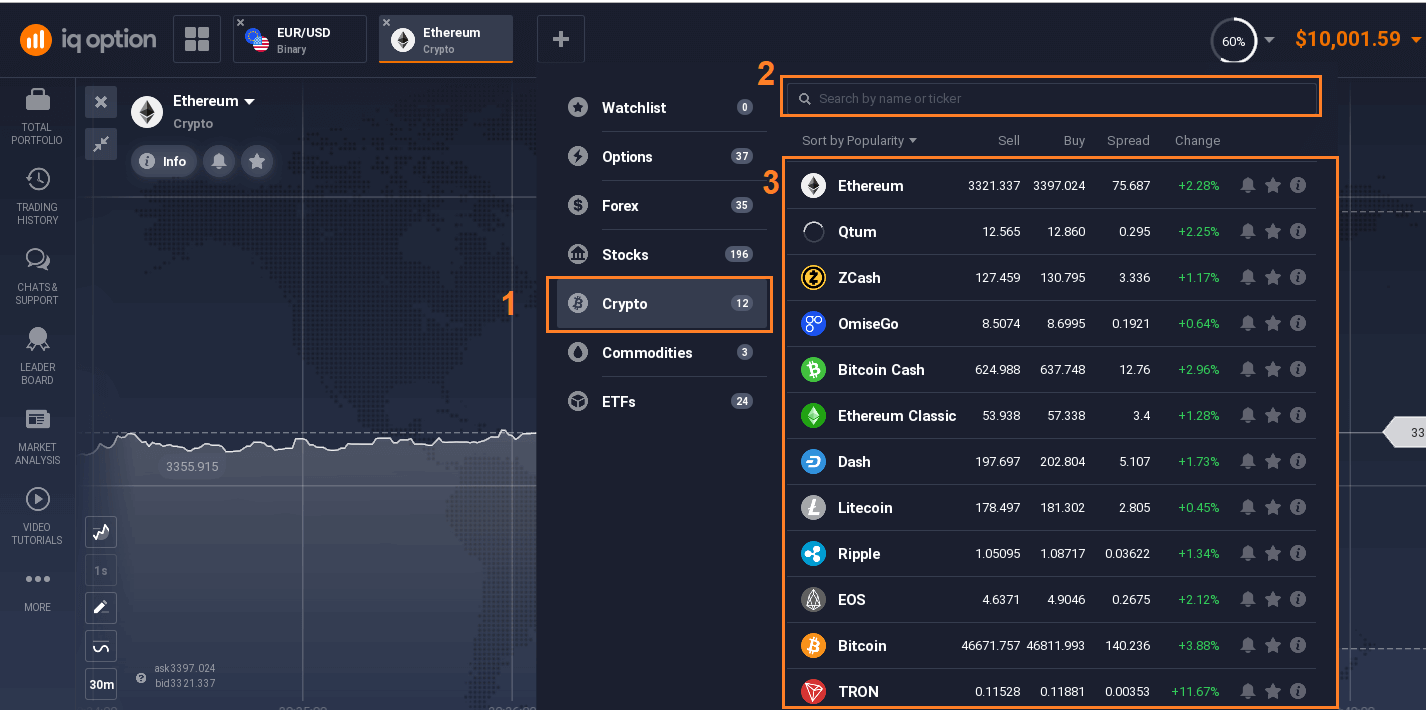

1. To begin trading on cryptocurrencies, you may open the traderoom and click the plus sign at the top to find the asset list

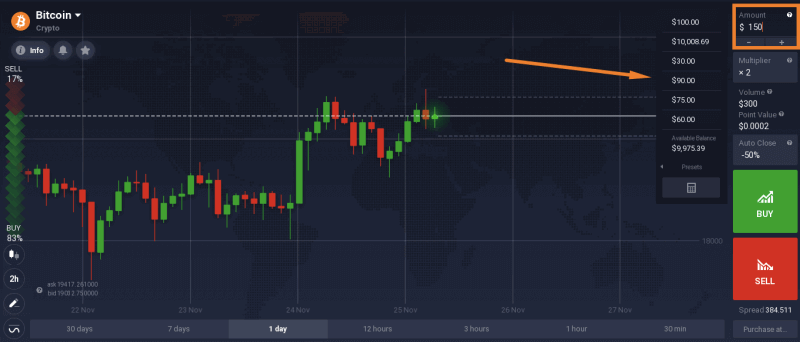

2. Find the cryptocurrency that you are interested in and choose the amount that you wish to invest in a deal

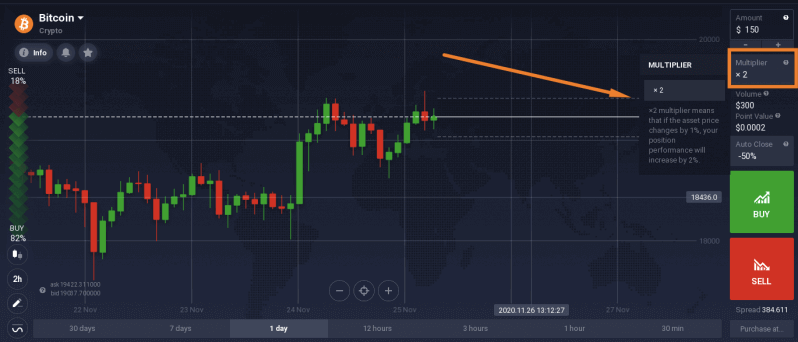

3. Note that cryptocurrencies are traded with a multiplier

The multiplier is an analogue of standard leverage. It provides you with the possibility of higher outcome, although it increases the possible risk of loss.

Based on your investment and the chosen multiplier, you will see the total trading volume of your deal. The trading volume is the amount which the outcome of the deal will depend on.

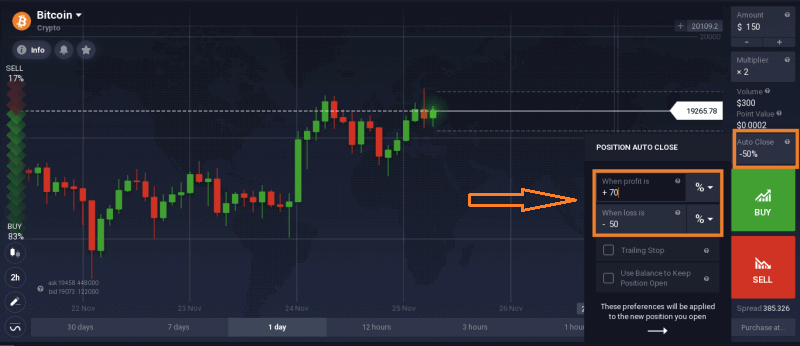

4. The last step before opening a deal is to set autoclose levels in order to adjust the deal to your preferred risk management approach

Note that a stop loss level of 50% is set to all deals automatically. It is possible to reduce this level (for instance, set it at 30%).

If a trader wishes to increase the level, they may utilize their balance funds in order to keep the deal open longer, even after the level of -50% is reached. A trailing stop loss may also be used in order to secure certain outcomes in case of a positive price change.

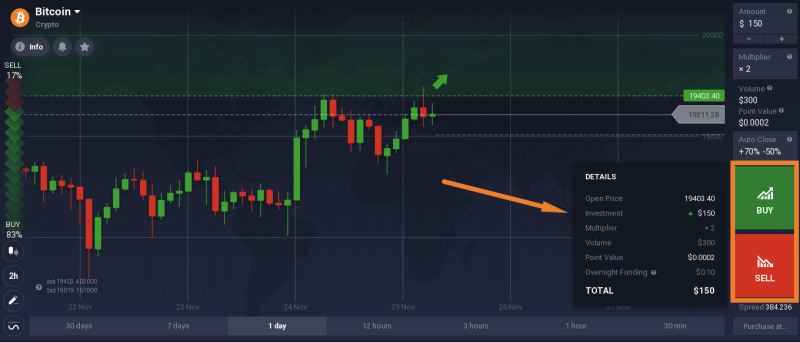

5. To open a deal, a trader will need to click the Buy or Sell button, depending on the expected price change: up or down respectively

When a trader clicks one of the buttons, the details of the deal they are about to open are available: the open price, investment, multiplier, volume, point value as well as the overnight charges. This way it is possible to double check all of the information before confirming the deal.

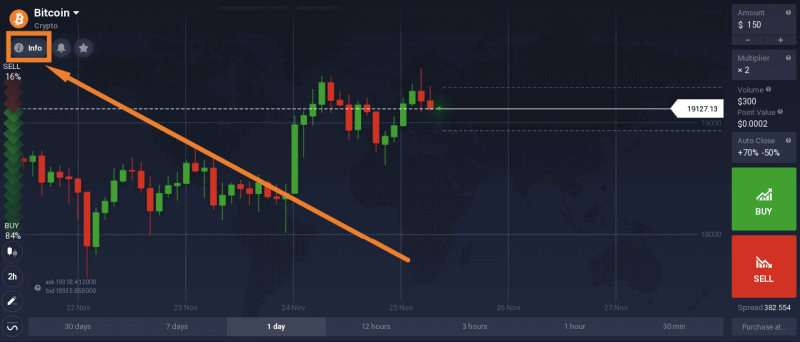

Market analysis

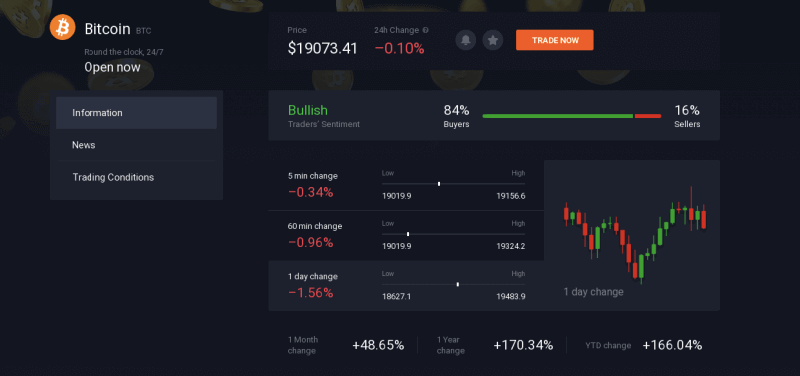

To make a decision regarding buying or selling of the cryptocurrency, traders may use technical indicators provided on the platform, or check out the “Info” section available for every asset in the traderoom.

This section displays the information about the current trend tendency (bearish or bullish), the summary of indicators’ signals and a lot more useful information that could assist a trader in making a well-informed decision.

You may also find the latest and most relevant updates about the asset in the “News” section. Though this section cannot replace a trader’s own analysis, it may help with forming a full picture of how the asset and the industry is doing.

CFDs on Stocks

Traders, working with IQ Option, have the opportunity to trade shares of the world’s most renowned and powerful corporations with the help of an instrument called CFD. The three letters stand for “contract for difference”. By buying the contract, a trader does not invest his funds in the company itself. Rather, he is making a prediction regarding future price movements of the asset at hand. Should the price move in the right direction, he will receive profit proportional to the degree of the asset price change. Otherwise, his initial investment will be lost.CFDs are a good way of trading shares without turning to shares themselves. Stock trading usually involves hassle that can be easily avoided when trading options. Stock brokers do not offer a wide range of investment instruments. On the contrary, when trading with IQ Option, you can trade equity, currency pairs and cryptocurrencies — all in one place. The latter makes trading less time-consuming and, therefore, more effective and comfortable.

How to Trade CFD on Stocks

This is how to trade CFDs on stocks on the IQ Option platform:1. Click the “Open New Asset” button in the upper side of the screen and choose ‘Stocks’ from the list of available options. Then choose the company you want to trade. Analyze the price chart using technical analysis tools. Don’t forget to take into account fundamentals factors, as well. Then determine the trend direction and predict its future behavior in the foreseeable future.

2. Set the amount of money you want to invest in this particular deal. Remember that in accordance with prominent risk management practices, you are not supposed to allocate your entire capital to a single deal.

3. Choose a multiplier and set up the auto closing (optional). A multiplier will increase both the potential return and risk involved. By opening a $100-worth deal with a multiplier of x5 you will get the same results as if you were investing $500. It applies to both profits and losses. Auto closing will let you close the deal automatically, whether to grab your earnings or manage your losses.

4. Now, depending on your forecast, choose either “Buy” or “Sell”. When the time is right, close the deal. The bigger the difference between the opening price and the current price (if the trend direction was predicted correctly), the higher the potential profit. Keep in mind that your deal will be subject to an overnight fee, so don’t keep it open for too long.

CFDs on Forex

Forex may seem complicated upon the first look, however, learning the important principles of it doesn’t take a lot of time. It is a big topic, but knowing just the main concepts may allow a trader to grasp the basics of Forex trading.In this part, we will learn what Forex means, how to understand the Forex chart and what analysis tools IQOption offers right in the traderoom for the trader’s convenience.

What is Forex?

Before going into it, it is important to understand (at least in general terms) what Forex is, why it exists and why it is necessary.The term “Forex” is short for foreign exchange and it is often referred to as simply FX. The foreign exchange market is the largest and most liquid market in the world. It is decentralized: it is not just one place, but rather a system of stable economic and organizational relations between banks, brokers and individual traders with the goal of speculation on foreign currency (buying, selling, exchanging etc.). The reason for forming one global currency market is the developing national currency markets and their interaction.

The foreign exchange market does not set an absolute value for a currency, but rather determines its relative value against another currency, this is why in Forex you will always see a pair like EUR/USD, AUD/JPY and so on.

Understanding the chart

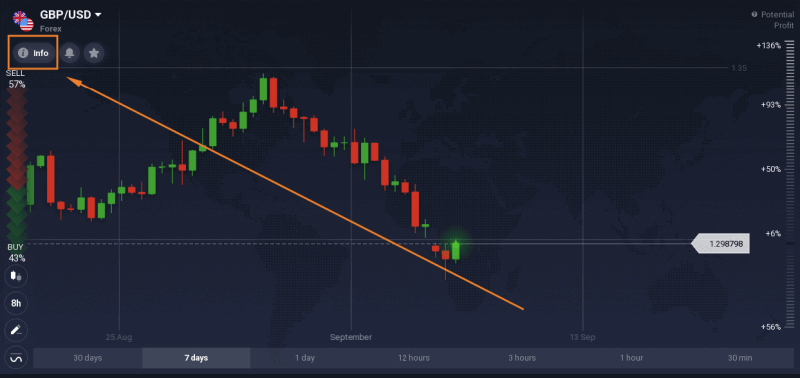

To understand the Forex chart, there are several main points to learn.1. Base and quote currency. The exchange rate always shows two currencies. In the pair, the first currency is called base and the second one is the quote currency. The price of the base currency is always calculated in units of the quote currency. For instance, if the exchange rate for GBP/USD is 1.29, it means that one pound sterling costs 1.29 US dollars.

Based on that, a trader can better understand how the chart is formed. If the chart on GBP/USD, for example, is going up, it means that the price of USD depreciated against GBP. And the other way around, if the rate is going down, it means that the price of USD grows against GBP.

2. Major and exotic currency pairs. All currency pairs can be divided into major and exotic ones. Major pairs involve the major world currencies, like EUR, USD, GBP, JPY, AUD, CHF and CAD. Exotic currency pairs are those that include currencies of developing or small countries (TRY, BRL, ZAR etc.)

3. CFD. On IQ Option, Forex is traded as CFD (Contract For Difference). When a trader opens CFD, they do not own it, however, they trade on the difference between the current value and the value of the asset at the end of the contract (when the deal is closed). This allows a trader to receive his/her outcome in accordance with the difference between the entry price and the exit price.

4. Multiplier. By using a multiplier, the trader gets the ability to manage a position that is greater than the amount of funds at their disposal. However, a higher multiplier also increases the risks involved.

How to Trade CFD on Forex

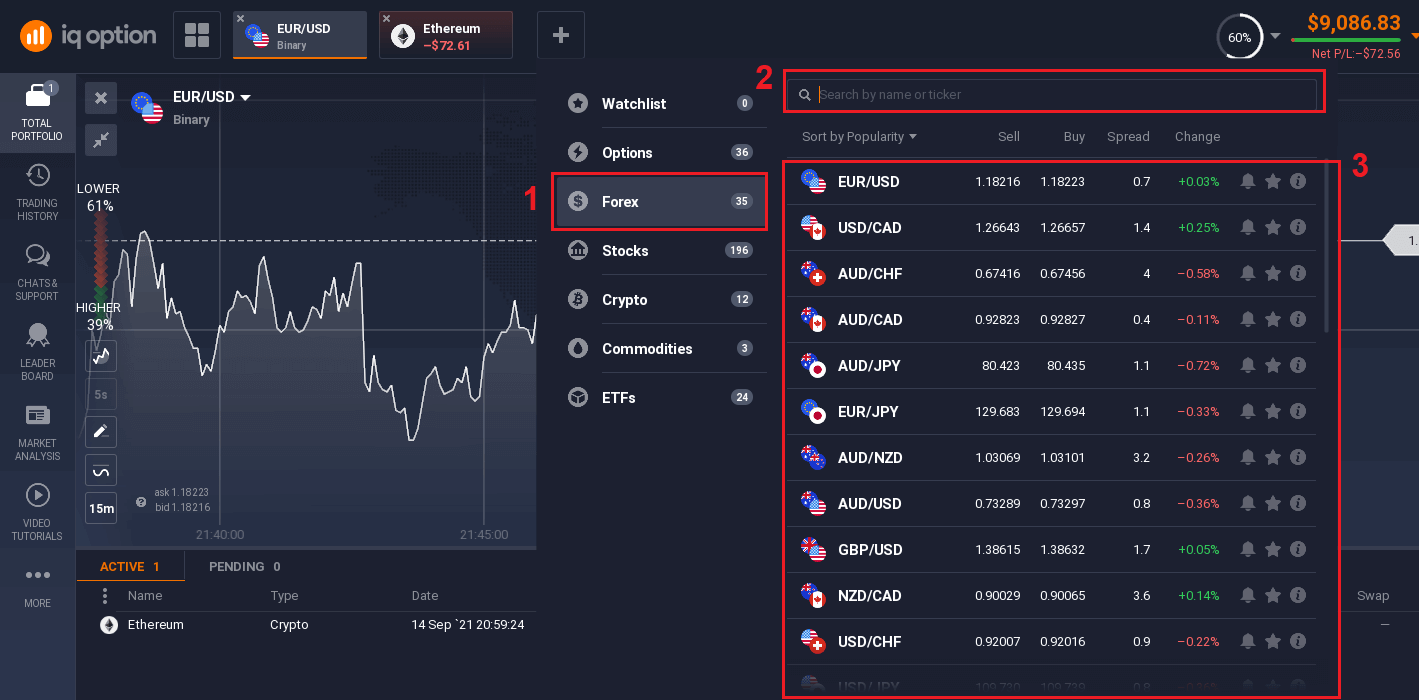

This is how to trade CFDs on Forex on the IQ Option platform:1. Click the “Open New Asset” button in the upper side of the screen and choose ‘Forex’ from the list of available options. Then choose the currency pair you want to trade. Analyze the price chart using technical analysis tools. Don’t forget to take into account fundamentals factors, as well. Then determine the trend direction and predict its future behavior in the foreseeable future.

2. Set the amount of money you want to invest in this particular deal. Remember that in accordance with prominent risk management practices, you are not supposed to allocate your entire capital to a single deal.

3. Choose a multiplier and set up the auto closing (optional). A multiplier will increase both the potential return and risk involved. By opening a $100-worth deal with a multiplier of x5 you will get the same results as if you were investing $500. It applies to both profits and losses. Auto closing will let you close the deal automatically, whether to grab your earnings or manage your losses.

4. Now, depending on your forecast, choose either “Buy” or “Sell”. When the time is right, close the deal. The bigger the difference between the opening price and the current price (if the trend direction was predicted correctly), the higher the potential profit. Keep in mind that your deal will be subject to an overnight fee, so don’t keep it open for too long.

CFD trading may seem easy due to low number of variables involved. However, it is as difficult, as it could be rewarding (if done correctly). Dedicating enough time to the company you are about to trade and learning how to use technical analysis tools in advance is always better than . Dive into the engaging world of CFD trading right now.

Analysis tools for Forex

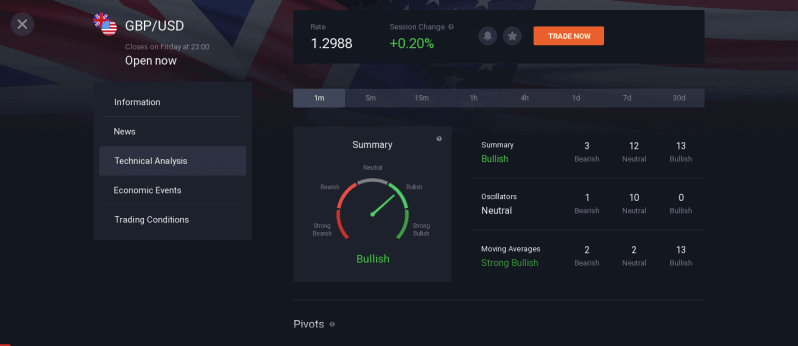

When a trader opens a deal on Forex on the IQOption platform, they make a prediction regarding the price development and they can benefit in case of a correct prediction. That is why a trader has to learn how to analyze the chart in an effective way.On the IQOption platform, every trader can find a lot of information regarding any asset, to do that, one just needs to click on the “Info” button under the name of the asset.

The button opens an entire section with plenty of information and analysis for the asset. It is possible to find general information about the currency pair there, as well as the trading conditions, important news that may affect the price, technical analysis and economic events.

Of course, this analysis should not replace a trader’s own analysis, however, it can sometimes be useful in order to make a well-informed decision. Besides the analysis offered in the “Info” tab, traders may also use the indicators and graphical tools in the traderoom.

As Forex is a complex tool, a trader may use the Practice balance in order to learn and improve their approach. Novice traders may want to implement a strong risk management technique, as well, especially at the very beginning.

Frequently Asked Questions (FAQ)

What is the best time to choose for trading?

The best trading time depends on your trading strategy and a few other factors. We recommend that you pay attention to the market schedules, since the overlap of the American and European trading sessions makes prices more dynamic in currency pairs such as EUR/USD. You should also follow market news that might affect the movement of your chosen asset. Its better not to trade when prices are highly dynamic for inexperienced traders who dont follow the news and dont understand why the price is fluctuating.

How does a multiplier work?

CFD trading offers the usage of a multiplier which can help a trader to control the position that exceeds the amount of money invested in it. The potential profitability (as well as risks) will also be magnified. Investing $100 a trader may get the return that is comparable to a $1000 investment. That’s the opportunity a multiplier can offer. However, remember that the same goes with potential losses as these would be multiplied as well.

How to use Auto Close Settings?

Stop-loss is an order that a trader sets to limit the losses in a particular open position. Take-profit works in much the same way, letting a trader lock in profit when a certain price level is reached. You can set the parameters in percentage, amount of money or asset price: example. You will find the detailed information here.

How to calculate profit in СFD trading?

If a trader opens a long position, the profit is calculated according to the formula: (Closing price / Opening price - 1) x multiplier x investment. If a trader opens a short position, the profit is calculated according to the formula (1-closing price/opening price) x multiplier x investmentFor example, AUD / JPY (Short position): Closing price: 85.142 Opening price: 85.173 Multiplier: 2000 Investment: $2500 The profit is (1-85.142 / 85.173) X 2000 X $2500 = $1.819.82